Banks are not charitable organizations. They exist to make as much profit from you as they can. They make sure that any business that applies for a loan is capable of repaying it.

Qualifying for a business bank loan is hard. It’s even harder for small businesses since most traditional lenders consider them to be high-risk clients.

There are a number of reasons why a bank may turn down a business loan application.

1. Inconsistent Cash Flow

Banks love predictability. For this reason, they are more likely to approve loan applications for businesses that demonstrate predictable monthly revenue and cash flow. Banks are very hesitant to give loans to businesses that do not demonstrate their ability to repay the loan.

2. Insufficient Collateral

In most cases, banks will require collateral from a business before approving a loan application. This is usually not a problem for large businesses that own properties. However, this can be quite a challenge for small business startups that do not have a property that can be held as collateral.

3. Unhealthy Debt-to-Income Ratio

Banks are hesitant to loan to businesses with an existing loan from another lender. They will carefully evaluate your level of indebtedness against available income to determine whether to loan your small business or not. As a general rule, most banks avoid giving out loans to businesses that are already indebted to other lenders.

4. Lack of Customer Diversification

Banks may refuse to grant a small business loan if the majority of that business’s sales are concentrated on a specific customer base. They like to see a diversified customer base as opposed to having a handful of regular customers. If your business exists on the strength of a select regular customer base, banks may consider this to be a risk not worth getting into.

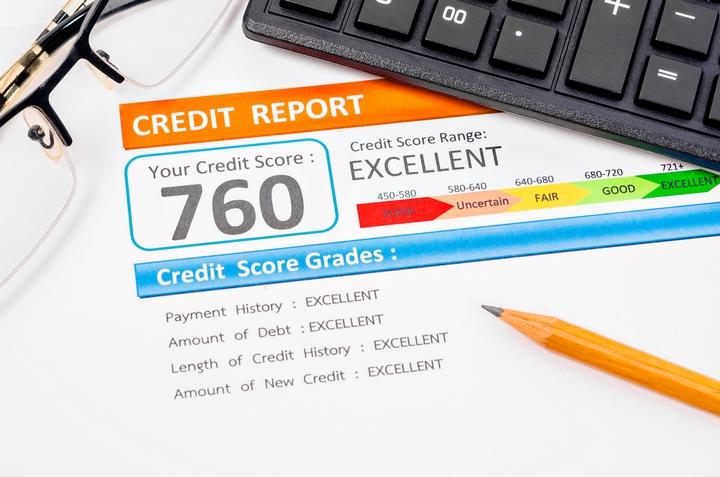

5. Poor or Bad Credit Score

Banks are increasingly relying on credit scores before approving a business loan application. In most cases, if the credit score is less than 720, chances are that the bank may decline a loan application. Unfortunately, most small and medium businesses find this requirement insurmountable.

6. Personal Guarantees

Banks require personal guarantees from business owners. This is done to ensure that the business owner takes personal liability for the loan. Most business owners hardly want to put themselves in this position since it can exert undue financial stress on them.

7. Insufficient Track Record

The longer a business has been in operation, the more likely that a bank will approve a loan application. A considerable track record of profitable operations over time tells a bank that your business has been tried and tested.

8. Current Economic Concerns

If the economy of a country is struggling, banks are unlikely to approve loans to businesses, especially small and medium businesses. Banks exist for their own interest. If they think that the economic conditions are not conducive, they may set qualification requirements that are way out of the reach of most businesses.

9. Weak Leadership

Banks scrutinize the top-level leadership of a business before approving a loan application. If a business does not have organizational integrity with clear lines of authority and responsibility, a loan application from such a business is likely to be declined.

10. Weak Industry

A bank may decline a loan application if it feels that your area of operation is weak or has limited opportunities. This is interpreted as potentially limiting your ability to repay the loan.

While it might be a difficult task to acquire a loan from traditional lenders such as banks, there are online lenders who will consider giving you a small business loan without collateral or with a less-than-impressive credit score. Although interest rates may be marginally higher than those charged by traditional lenders, online lenders provide a viable option for businesses seeking to fund their expansion and growth.